Tuesday, December 31, 2013

Saturday, November 30, 2013

A little on China's economic reform announcements

This month China’s

leading party announced a package of economic reforms. This involved promise of changes to the one-child

policy and residency laws; more important to buy-side firms were the financial

measures. State-owned banks now face competition from the private sector; there

will be deregulation with regards to interest rates; and capital controls will be

relaxed. Whilst a dream for proponents of the free-market, it may not be a good

one. Aside from other external factors, there are a lot of issues that will arise

from these economic reforms which the street truly has not taken into much

consideration. SOEs have stayed afloat under cheap credit, although often not repaid

loans; and banks, to compensate, have profited from inflated net interest margins.

China gorges on cheap credit. Liberalising this would raise borrowing costs,

and would certainly bring a tide on many struggling firms with insolvency

becoming a lot more evident. In addition, Chinese Banks cannot continue current

lending practices. So whilst the sell-side may upgrade many, caution should definitely

be taken if ‘buys’ are fuelled by macro thoughts. Additionally, the street

truly has not accounted for China’s capital account liberalisation potentially seeing

capital outflows rather than inflows.

Monday, November 25, 2013

21st Nov recap, 20th Nov recap

21st

November summary

Stocks were

mixed in Europe and APAC as investors reacted to FOMC minutes on Wed. US share

indices rallied after earlier decline in the week.

US

Stocks rebounded Thursday – economic data pointed to a slowly improving labor

market and subdued inflation. Financial shares lef the market higher. Yellen

talks about the need to support the economy. DJIA at all time high – crosses

16000 for the first time ever. S&P neared the 1800 milestone (which it

reached the following day! On Friday 22nd Nov!). Initial claims for

jobless benefits declined 21000 to 323,000 in the latest week – from a revised

344,000 the week before. Marking flash manufacturing PMI jumped to 54.3 from

October’s final reading of 51.1. Senate Banking committee voted to approve Yellen’s

nomination to become Fed chair next year. Dollar was up against the JPY, CAD

and AUD.

Europe

Most indices declined, weaker than expected PMI from France and China – and

some worry that FED will begin reducing stimulus – although there are arguments

for continued QE as well as its tapering. MIB (Italy) was up 0.6% however, and

IBEX (Spain) up 0.4%. All other markets saw some retreat. China’s November

flash PMI declined to 50.4 from 50.9 in October. Eurozone – Germany’s reading

improved, France’s readings showed contracted in manufacturing and services.

Eurozone’s private sector growth weakened for the second straight month. Raises

concerns about Eurozone economic recovery. Although last week Ireland’s

APAC

All except Japan were down Thursday. Prospect of changes in Fed monetary policy

still driving markets. Nikkei only jumped due to Yen’s decline against the

dollar. Bank of Japan has left its monetary policy unchanged once again.

20 November

– Most global markets declined as investors eyed Fed’s policy announcement.

One thing that most FOMC participants agreed upon was that

curtailing quantitative easing should not be automatic. Rather,

determination of when the Fed might move continues to depend on economic data.

The discussions were wide ranging. They covered such subjects as by how much

should bond purchases be cut, which bonds should be cut — Treasuries and/or

mortgage backed securities — and whether to change the rate paid on excess

reserves. They also discussed whether qualitative guidance is better than

specific numeric guidance such as explicit unemployment and inflation numbers.

The Bank of

England released minutes of its monetary policy committee meeting held earlier

this month. At that time, the MPC unanimously decided to retain its 0.5% interest

rate and the £375 billion ceiling on its asset purchase program. The minutes

implied that the interest rates are unlikely to rise in the foreseeable future

even if the unemployment rate reaches its 7% threshold. The minutes echo the

message of the Inflation Report released last week.

The Shanghai Composite was up 0.6% to a near one month high

and the Hang Seng edged up 0.2% after the People's Bank of China signaled it

would end normal intervention in the currency market and quicken the process of

full yuan convertibility. The central bank plans to widen the yuan's trading

band "in an orderly way" while increasing the currency's two-way

flexibility.

11 - 18th Nov summary

Global

Markets Weekly 11 - 18 November 2013

http://www.coutts.com/wealth-management/investment-perspective/global-markets-weekly/2013/18-nov-2013/index.asp

http://www.zerohedge.com/news/2013-11-22/sp-closes-above-1800-posts-7th-consecutive-weekly-increase-longest-streak-2007

http://www.zerohedge.com/news/2013-11-22/sp-closes-above-1800-posts-7th-consecutive-weekly-increase-longest-streak-2007

Economics

Ireland

leads improving periphery – looks set to request an exit from Troika programme

EU, ECB and IMF. Suggests it can fund itself but challenges remain. Will

attempt to raise money in bond markets next year – without line of credit in

place from Troika. Has accumulated €25bn in cash, well above the 6-10€bn of

bond issuance next year. Enough funds to finance itself for some time – can approach

Troika again if needed – although there is some conditionality (probably the

reason Ireland opted for no credit line).

Although in reality, this success is dubious and has come at a cost –

severe austerity measures (à highest emigration in Europe, country’s debt

to GDP is 123%, 4x higher than before the banks were bailed out). Spain too is

expected an end to its bailout program – which ultimately went to struggling

banks rather than government – and needed only €40bn of the €100bn offered. Enormous

problems like billions in bad debt and high unemployment still plague Spain.

Expect

other two bailout recipients – Greece and Portugal to remain under some form of

support/.control from Troika.

Equities

Chinese

equities have rebounded from a sharp sell-off amid initial disappointment – as

details emerged from seminal plenary session of China’s leaders. Report was

thin – some measures been announced – land reform, loosening of the one-child

policy, marking it easier for labour to move across the country and encouraging

the private sector.

Pivotal

couple of weeks for the UK and Eurozone central-bank policy – bringing an

upgrade to UK growth forecasts and an unexpected rate cut in Europe (0.5 to

0.25%). After a strong performance over the pase year, UK equity valuations are

probably becoming less attractive – neutral outlook. Europe still potentially

attractive as an equity market – supported by more aggressive stimulus from the

ECB (counterargument: maybe that’s already priced in and valuations aren’t that

attractive?)

Bonds

Shrinking

yield premiums (spreads) of non-government over safer government bonds, and an

uncertain fiscal and monetary policy outlook in the US mean that finding value

in fixed income markets is getting challenging.

Take of US

Fed winding down QE may die down after Chairman-elect Yellen noted need to

support fragile recovery by maintaining easy monetary policy. With yields low,

we are careful in balanacing duration (sensitivity to interest-rate changes)

against risk of default – taking less credit risk when buying longer-dated

(higher duration) bonds and vice versa. Favour three areas: dollar-denominated

Asian debt, emerging-market corporate bonds and financial debt.

Commodities

Latest quarterly report from World Cold Council shows D for gold fell in Q3 with large redemptions of Gold ETFs. Whilst ETF outflows grab the headlines, report shows demand for physical gold remains robust – led by Chinese consumers buying jewellery. Irrelevant for market price, however. Despite 5 years of aggressive central bank stimulus, many economies still rely on proactive policymaking. Global risks still exist – and the world will still face continuing easy monetary policy probably. Fundamentals still favour gold over medium term.

Latest quarterly report from World Cold Council shows D for gold fell in Q3 with large redemptions of Gold ETFs. Whilst ETF outflows grab the headlines, report shows demand for physical gold remains robust – led by Chinese consumers buying jewellery. Irrelevant for market price, however. Despite 5 years of aggressive central bank stimulus, many economies still rely on proactive policymaking. Global risks still exist – and the world will still face continuing easy monetary policy probably. Fundamentals still favour gold over medium term.

Thursday, November 21, 2013

What's another word for ridiculous? Goldman Sachs valued the Royal Mail at £3.3 bn. JPMorgan valued it at £6.8bn to £8.5 bn. Deutsche Bank valued it at £5.5bn to £6bn. Goldman (and UBS) got the job because they were offering to do it for a lower fee

http://www.thetimes.co.uk/tto/business/industries/banking/article3927547.ece

Friday, November 8, 2013

7th Nov Recap

US

Stocks

declined – over concerns regarding what a stronger Q3 GDP means for Fed policy –

good news is bad news. On that note – intial jobless claims were down 9000 to

336000 in the latest week. But good news is still good for currency, and

speculation of tapering also good for currency à US dollar appreciation against EUR,

GBP, CHF, CAD, AUD… but down against JPY. Dollar index up 0.4%

Surprise

ECB cut – provided an early boost for shares.

Twitter – a

distraction from Fed policy debate. Updated: Twitter share price soars! http://uk.finance.yahoo.com/news/twitters-share-price-soars-opening-160733676.html

Europe

Stocks – mixed. Investors react to the cut. Initially

markets rallied but then weakened. BoE left rate unchanged – as expected.

FTSE down 0.7%, CAC down 0.1%, DAX up 0.4% and SMI up 0.1%.

ECB cuts rates to 0.25% - alongside low inflation and 12.2%

unemployment. Prior the rates had been lowered to 0.5% in May. ECB also cult marginal

lending facility rate by 25 basis points to 0.75%. The previous change was a 50

basis points cut in May. Deposit rate - left unchanged at 0.

BoE kept key rate at current record low - 0.5%, and asset

purchase program ceiling at £375 billion - pledged not to raise rates until the

jobless rate falls to 7%.

APAC

Stocks declined as investors awaited the ECB’s monetary

policy announcement and US growth and employment data.

Sunday, November 3, 2013

Saturday, November 2, 2013

But are you even surprised anymore?

The five Congressmen/woman: Alan Grayson, D Florida; Jan Schakowsky, D Illinois; John Conyers, D Michigan; Rush Holt, D New Jersey; Rick Nolan, D Minnesota.

Friday, November 1, 2013

Thursday, October 10, 2013

Tuesday, October 1, 2013

Tuesday, September 24, 2013

What would you do if your salary was only $100/month? Well, these guys.. are only asking for $100/month

Bangladeshi garment workers.

Yes.. convert according to purchasing power, Big Mac indexes and all the rest of it. It's still nothing. Their current wages, are even less than nothing. $38/month.

http://portside.org/2013-09-23/dozens-injured-200000-bangladesh-garment-workers-demand-wages-100-month

Yes.. convert according to purchasing power, Big Mac indexes and all the rest of it. It's still nothing. Their current wages, are even less than nothing. $38/month.

http://portside.org/2013-09-23/dozens-injured-200000-bangladesh-garment-workers-demand-wages-100-month

Monday, September 16, 2013

FOMC, the rest of the week and goodbye Summers

OK, so the following is just a jot down of my ideas for this week. It's not very well written, but I think all the points are there.

Summers does not want the position

Negative for the US dollar

Positive for risk sentiment

Does not guarantee that Yellen will be the next Chairman. Kohn is the other candidate.

Positive for risk sentiment

Does not guarantee that Yellen will be the next Chairman. Kohn is the other candidate.

Yellen - More dovish then Summers. (comparatively). Favourable on QE.

The even mention of Taper caused volatility in June. Yellen

is seen as an extension of Bernanke.

Critical event risk this week – FOMC monetary policy

announcement. Taper size of asset purchases.

Quarterly policy meetings. June

talked about the idea of reducing the size of its monthly asset purchases.

After this meeting, next big meeting is December.

Look at the taper as an important

catalyst. Since June we’ve really seen Fed officials massage this idea. Built

up so much speculation consistently, to the extent that they have done, would

be a credibility issue. Would bring into question the way the central bank communicates

monetary policy. Why wouldn’t they taper? I don’t think there is any answer to this.

Asset purchases probably go down from 85bn a clip (40bn in MBS, 45bn in US govt

bonds) to 70-75bn a clip (which will be in treasuries). Wants to do treasury

side first, does not want to spook housing market. It’s already priced in.

USD positive or negative? Nothing in isolation. It’s already

priced in.

Larger question is – what surrounds that announcement? What

happens after September? Is this the beginning of a cycle? Or when is the next

Taper. When is QE wrapped up? Bernanke has alluded to mid-next year round up.

Or does everything remain contingent on economic data?

Consensus view- Fed will reduce their outlook for economic

growth. May not happen, that we’ll have to see. What does it support? This is the marking

movement component.

If the baseline is 10-15 and the Fed does 5: Dovish – dollar

negative

20+, Hawkish outcome – dollar positive

20+, Hawkish outcome – dollar positive

It’s the forward

guidance that is going to be market moving.

Besides the FED, there are a number of important considerations.

Today, Eurozone CPI has come out. 1.3%, came out fine.

Industrial Production a little weaker m/m. 0.4% vs 0.5%

forecast.

ZEW economic survey – German is the focus number. Less

relevant that hard data probably.

ECB – guidance -> rates will remain at the current rates or lower. If get data that’s relatively positive, it will suggest that rates will stay same rather than move lower. Or lower component is where the speculation is.

ECB – guidance -> rates will remain at the current rates or lower. If get data that’s relatively positive, it will suggest that rates will stay same rather than move lower. Or lower component is where the speculation is.

Or negative data – expectation is that rates may go lower,

or even that ECB moves forward with another liquidity injection setup similar

to LTRO (late 11, early 12 introduced… in repayment now)

Also looking at UK CPI numbers, again in the context of

guidance for the BoE. BoE has already talked about strict knockouts. If any of

the following knockouts occur, the BoE needs to reconsider:

2.5%+ for 18 – 24 month, the number we’re looking at is the Y/Y August number where we’re looking at around 2.7%.

2.5%+ for 18 – 24 month, the number we’re looking at is the Y/Y August number where we’re looking at around 2.7%.

Current forecasts from survey of economists carried out by

Bloomberg: Coming quarters 2.7% in Q3, 2.5% in Q4 and 2.2% Q1, 2.5% Q2, 2.3% Q3,

2.25% Q4, annual average of 2.3% and 2.1% in 2015. 5 year breakeven is around

2.8% if you look at the difference between inflation linked bonds and

non-indexed govt bonds. But does this tell us anything? Probably not. It’s

reduced a lot actually. Someone is right, someone is wrong. If we get a softer

number of CPI, we are likely to get the British pound lower.

Basis for a EUR/GBP trade, short setup is that ECB is more

dovish than BoE. But bottom of a channel at the moment at around .8384. Looking

further down the week,

RBA, and BoE probably won’t say anything (Tues and Wed

respectively). After FOMC, we have NZ number where we are looking towards a slowdown

in growth to around 0.2%, RBNZ looking to raise rates most likely in 2014,

however a softer GDP number might start to erode that idea. But it’s somewhat

flimsy to look into next year. If the situation is materially softer, it won’t

give you rate cuts, but you’ll certainly

begin to erode the outlook for the year ahead (where we’re looking for a 75bp

to 100bp, we’re at 2.5% now). Soft GDP à

NZD a little lower

SNB rate decision. Inflation forecast might be market

moving. Object of the floor that the SNB has placed on the Eur Swiss exchange

rate has been to fight inflation. Might be interesting to keep an eye on this.

Tuesday, September 3, 2013

Mis-smile :(

On this morning's unexpected joint Israel-US missile test launch.

From Bloomberg:

- Israel missile defense organization, U.S. missile defense agency completed successful flight test of new version of the “sparrow target missile” today, Israeli Defense Ministry says in e-mailed statement.

- Arrow weapon system’s radar successfully detected, tracked target; all elements performed according to configuration

- Israeli Defence Ministers says Missile Test was successful

- Isreal's Ya'alon says new technology must be tested.

Friday, August 30, 2013

Wednesday, August 28, 2013

Courtesy of Zerohedge and Bloomberg. A summary on Syria

U.S. ACTIONS:

- Obama Begins Selling Action Ahead of Decision on Force

- U.S. and Allies Move Closer to Brink of Syria Military Action

- U.S. to Release Syria Gas Attack Proof

- Tomahawk Missile Launches Likely in U.S.-Led Attack on Syria

- U.S. Said to Weigh Legal Justification for Attack on Syria

SYRIAN ACTIONS:

- UN Syria Envoy Says Strikes Can’t Precede Council Decision

- Rebels Used Chemical Weapons: AFP Cites Syrian Ambassador to UN

- Syria Evacuates Troops From Damascus Military Base: Arabiya

- Syria Foreign Minister Denies Chemical Attack to BBC

- Assad Not in Iran, Mehr Says, Citing Iranian Foreign Ministry

INTERNATIONAL ACTIONS:

- U.K. Drafts UNSC Resolution to Protect Syrian Civilians

- Cyprus Says Hasn’t Heard From U.K. on Use of Bases for Strike

- Iran’s Khamenei Says Syria Attack Would Be ‘Disaster’

- Ban Ki-Moon Says Syria Now in Most Serious Moment of Conflict

- Italy waiting on UN

- Russia FM Says Rejects U.S. Assessment of Chemical Attack

- Germany May Participate in Syria Action: Rheinische Post

- German CDU Party Lawmaker Calls for “Surgical Strike”

- Hollande to Meet Head of Opposition Syrian National Coalition

- Recalls French Parliament to Discuss Syria, Spokeswoman Says

- Israel Warns Iran, Syria Against Reprisal for U.S. Strike

- Strike Would Lead to Retaliation on Israel, Iran Warns, According to NYT

MARKET REACTION:

- WTI Crude Rises to Two-Year High

- Oil Diverges From U.S. Stocks Most Since 2011 on Syria

- Brent Crude May Spike to $150 on Syria Spillover: SocGen

- Libya Compounds Syria Tension in Oil Market

- Bond Markets Price in Syria Strike, Not Wider Clash

- European Stocks fall to 6-Week Low

US, Britain and Israel have used chemical weapons within the last 10 years... Kind of..

- ArticleA debate on the above:ABC I don't want to get too semantic, but neither depleted uranium nor white phosphorus are chemical weapons? I agree that both have horrible effects if used in the wrong circumstances, but there's an important line between these and chemical weapons per se.

For example, depleted uranium's primary effect is that it's an extremely dense material which punches through fortifications. The problem with DU is that it has toxic and radioactive properties which, in cases like Fallujah in '04, where extreme quantities built up in a place which was still inhabited by significant numbers of civilians, could have caused horrors like birth defects. While dreadful and regrettable, and I don't mean this to somehow atone, these effects are extrinsic to the intent of the attacker. The shells aren't fired with the intention of causing birth defects.

The primary effect of nerve agents (i.e. proper chemical weapons, which incidentally are only confirmed to be stockpiled by four countries in the world), however, is to attack the central nervous system, with the typical result of constraining people's muscles so they lose control of their bodily functions, suffocate and die. Historically, they have typically been used en masse to injure and kill with the full intention of these horrible effects.

All forms of death are as grim as each other, but I think it's important to keep a view on intent. I don't think the claims of hypocrisy are justified. - XYZ Deploying DU and white phosphorus with the knowledge of those effects is tantamount to deploying them with those intentions...

- ABC I disagree, though to get into my reasons would involve some pretty dry and abstract ethical reasoning. I agree that to deploy DU and white phosphorus with knowledge of the effects is morally bad. (Though I'd leave out white phosphorus and just stick with DU; it's really quite a different case and is nowhere near the same league as chemical weapons.) I just think there's qualitative difference between the use of the them versus 'conventional' weapons which needs to be maintained else we end up in unhelpful reductionism.ABC i.e. Bullets are pretty nasty, too! Where do we stop?

- ABC Furthermore on DU, the US military at least doesn't believe there's even a negative effect on the health of its own troops. One could question the honesty of that assertion, but assuming it's sincere then I don't think we can attribute to them true knowledge of the effects which we believe ourselves.

- XYZ i understand your point, i just dont agree that we only hold states responsible for the 'purported' intentional effects of their weapons, if theyre fully cognisant of toxic and radioactive qualities of these weapons then it seems to me that they are deploying toxic and radioactive arms

- ABC Oh of course I agree; effects are what matter. I'd just maintain a hierarchies of evil, so to speak. One of the cleanest deaths in war is a bullet through the head. One of the ugliest is lingering death in a trench from nerve gas. We're still working out how bad DU is along that scale, with both primary and secondary effects included (in time I imagine countries will ban its use in civilian areas and perhaps stop using it altogether), but I don't believe it shares its character with nerve gas either in the typical intent causing its use or in its sum effects.

- ABC In a sentence, we're shits, but they're worse shits.

Tuesday, August 27, 2013

Wednesday, August 21, 2013

Tuesday, August 20, 2013

Friday, August 16, 2013

End of Tapering Panic

The Risk-off trade that occurred after the wake of the Fed panic is getting unwound:

-Bonds rated CCC lower lost 2.4% since May 22 and June 19

(Bernanke's comments) since then debt has rebounded nicely by 3.5%

-Most risk assets “have probably retraced a good 75 percent on average of the widening that occurred in the late May and June period,”

However risk trades getting unwound is a worry, here's why:

The end of QE signaled a shift in how the Fed wanted to communicate about risk. As QE was meant to push down risk premiums, the end of QE is likely to push up risk premiums:

-Dont expect the Fed to push yields down anymore, they wont be pushing you to take risk

-For stocks they will rise if the economy lifts off - however dont expect P/Es to go up - the Fed will not push the P anymore, rather the E component will lower the ratio

-DBV Carry trade (e ETF that is short three currencies and long three currencies at all times) DBV tanked since May 22 and it has struggled with a key technical resistance level. Does this look like that risk is getting bought again?

-However, The EMB/HYG (emerging markets to high yield bonds etf) ratio fell through a key relative support level and has had trouble regaining relative strength. So risk on may not be coming back globally, market hasn't totally "healed"

Thursday, August 15, 2013

Check your stats - UK unemployment

While the government points to the fall in unemployment by 4,000 to 2.51 million between April and June (Office for National Statistics) as evidence for the successes of austerity, this view is barely skin deep.

- The unemployment rate holds fast at 7.8% -- essentially more people in work is just a symptom of a growing population. In reality, the jobs market is stationary: just about keeping up with new entrants. (ONS)

- All else being equal, the people that need most help getting a job are young people and those in long term unemployment. Yet unemployment actually rose in both groups by 10,000 and 15,000 respectively. Yet another indication that the gap between the 'haves' and the 'have nots' is widening. (ONS)

- Even for those that have work, real wages are still declining: average wages (including bonuses) averaged a 2.1% increase between April and June, while CPI for June shows that the cost of living increased by 2.9%. (ONS)

- The unemployment rate holds fast at 7.8% -- essentially more people in work is just a symptom of a growing population. In reality, the jobs market is stationary: just about keeping up with new entrants. (ONS)

- All else being equal, the people that need most help getting a job are young people and those in long term unemployment. Yet unemployment actually rose in both groups by 10,000 and 15,000 respectively. Yet another indication that the gap between the 'haves' and the 'have nots' is widening. (ONS)

- Even for those that have work, real wages are still declining: average wages (including bonuses) averaged a 2.1% increase between April and June, while CPI for June shows that the cost of living increased by 2.9%. (ONS)

Wednesday, August 14, 2013

Corporate Issuance Back after 2 month lull

-After selloff during May and June, investors are coming back to tap high grade and alternative markets (PIK toggle)

-Institutional clients continue to hunt for yield after Taper Tantrum

-The average extra yield investors demand to hold investment-grade corporate bonds rather than similar-maturity Treasuries tightened 0.5 basis point to 128.5 basis points

-Push into higher yields as investors see QE positives

New issues:

-Viacom sold $3bn with $500mn 2.5%, $1.25bn 10yr of 4.25% at 178bps and $1.25bn of 5.85% 30yr

-Kodiak Oil&Gas, below investment grade sold $400mn up from a planned 300 at 5.5%, same it paid for $350mn offering mid-Jan. Priced lower than 6% as oversubscribed ($1.6bn)

-Institutional clients continue to hunt for yield after Taper Tantrum

-The average extra yield investors demand to hold investment-grade corporate bonds rather than similar-maturity Treasuries tightened 0.5 basis point to 128.5 basis points

-Push into higher yields as investors see QE positives

New issues:

-Viacom sold $3bn with $500mn 2.5%, $1.25bn 10yr of 4.25% at 178bps and $1.25bn of 5.85% 30yr

-Kodiak Oil&Gas, below investment grade sold $400mn up from a planned 300 at 5.5%, same it paid for $350mn offering mid-Jan. Priced lower than 6% as oversubscribed ($1.6bn)

Tuesday, August 13, 2013

Event Risk in the coming month (and a bit)

21/08/13 - Release of minutes from 30-31/07 FOMC meeting

05/09/13 - 1) Japan announces its 2014 money supply target, 2) ECB Interest Rate decision

09/09/13 - Congress returns to session

18/09/13 - FOMC decision and press conference

22/09/13 - German federal elections

30/09/13 - Deadline for Congress to prevent government shutdown

Thursday, August 8, 2013

Europe?

Stronger macro data suggests that the worst of the Eurozone

crisis may be behind us. Last week, Eurozone consumer confidence strengthened

for the eight consecutive month, which could bode well for consumer spending in

coming months.

New orders placed with German manufacturers jumped a

seasonally adjusted 3.8% monthly, more than reversing May's revised 0.5%

decrease. Italy's longest recession in the post- World War II era eased in the

second quarter of 2013 with the gross domestic product declining 0.2% on the

quarter — the slowest pace in nearly two years. Britain's industrial production

was up 1.1% on the month following three consecutive months of zero growth. The

1.1% increase was the fastest since July 2012, when it grew 3.1%.

^^

This is the consensus it seems. I'm skeptical. Countries are broke, burgeoned with debt. No-one really knows whats going on. But, for sure, those who have been thick skinned in the last year have reaped the rewards. Look towards equity markets, peripheral debt. Is it too late to get in? Maybe. But this may give you some food for thought:

Tuesday, August 6, 2013

Understanding new GDP calculations for the US

Intellectual property product investment (IPP) has been

added to the National Income & Product Accounts (NIPA) – as party of July’s

benchmark GDP revisions (hence inflating GDP to 1.7% - although this far beat expectations of 1.1% regardless). The new category introduces

spending on entertainment, artistic and literary originals (EALO) (basically

goods that the rich can afford), software and R&D. Software, however, has

already been around in the GDP measurements but has been reassigned from one

way or another – something about ‘legacy equipment investment’ category. Adding

R&D and EALO has lead to an increase in real GDP growth by 0.07% (approx..)

since 1947 with large contributions during the .com boom in the 90s.

Thursday, August 1, 2013

Japanese debt: A perspective for beginners (i.e. myself!)

2012 – Japan’s central govt was 997trn in debt, that’s 200%

of GDP, and more than $80,000 (USD) per capita.

To understand any debt workflow:

The government collects taxes from households and corporations.

The government spends.

If wants to spend more than revenues, issues bonds.

When outstanding debts get too large, central bank lowers the interest rates or buys bonds.

For the government to spend more, it issues debt again.

Investors buy (and receive interest).

Investors worry when debts get too large.

Then Central Bank lowers interest rates.

Investors’ worries are intermittently allayed, and they continue investing.

Eventually it leads to an inescapable trap.

Each year the government has to pay interest, and fund other expenditures.

Investors sell.

Government cannot spend what it does not borrow.

Printing press can’t help now.

Inflation been going on as well.

Investors sell bonds to account for inflation.

Debt costs are higher than tax revenues.

The government spends.

If wants to spend more than revenues, issues bonds.

When outstanding debts get too large, central bank lowers the interest rates or buys bonds.

For the government to spend more, it issues debt again.

Investors buy (and receive interest).

Investors worry when debts get too large.

Then Central Bank lowers interest rates.

Investors’ worries are intermittently allayed, and they continue investing.

Eventually it leads to an inescapable trap.

Each year the government has to pay interest, and fund other expenditures.

Investors sell.

Government cannot spend what it does not borrow.

Printing press can’t help now.

Inflation been going on as well.

Investors sell bonds to account for inflation.

Debt costs are higher than tax revenues.

To put this in perspective for Japan, let’s take figures

from the end of 2012 fiscal year – Japan’s debt was 23x revenues. 1% increase

in average debt cost increases overall interest expense by 23% of tax revenues.

By this calculation, the govt needs to keep debt costs lower than 4%. Can they

do this? Yields are only 0.8% at the moment. But what about in the future? Let’s

look at investor rationale.

Japanese investors – JGB bond prices are very high, and a

lot has been invested in JGBs by locals. But savings are declining with an

ageing population, so can they keep the demand for the debt so high?

Foreign investors see only 0.8% yield?! OK inflation in real terms is low, so the yield is now that bad. Last year yields were around -1% with inflation of -1%, that’s a real return of 2%, right?! But now, inflation has been increasing, (0.2% June YoY, -0.2% if you discount food and energy prices) and will continue to increase because of the 3 arrow approach taken by Abe and Kuroda. They are targeting 2% inflation, so to keep real returns constant the average debt cost may rise to 4% and this is the critical point.

Foreign investors see only 0.8% yield?! OK inflation in real terms is low, so the yield is now that bad. Last year yields were around -1% with inflation of -1%, that’s a real return of 2%, right?! But now, inflation has been increasing, (0.2% June YoY, -0.2% if you discount food and energy prices) and will continue to increase because of the 3 arrow approach taken by Abe and Kuroda. They are targeting 2% inflation, so to keep real returns constant the average debt cost may rise to 4% and this is the critical point.

The Kyle Bass view (Hayman Capital) is essentially that

there will be a collapse in Japanese bond yields because its expansion

ultimately engenders this Weimar style of hyperinflation. – and you can watch

some of his talks online for example here.

What this does not take into account however is that, whilst

it well know that in a recovery, bond yields go up, the extreme scenario is

unconvincing. This is because it doesn’t account for the increase in tax

revenue that will follow from increase in GDP – the Japanese tax structure is

very pro-cyclical (although less so now than in the 1990s due to the

introduction of consumption tax). The origin of fiscal stresses isn’t really

fiscal spending but instead is tax revenue based – tax revenue today is only

60% of the level of 1990. Personal tax revenues have gone down compared to GDP,

and consumption tax hasn’t done much to replace loss of tax revenue. However if

Japan truly does grow, the increased strength in fiscal position could be

enough to offset interest payment increases.

Tuesday, July 30, 2013

US changing the way GDP is measured (and convenient thus reducing the Debt to GDP ratio by 0.5%). Have a read:

http://rt.com/business/us-adds-gdp-history-changed-740/

Bradley Manning. Salute.

Bradley Manning verdict: guilty of most charges but not 'aiding enemy' – live

http://www.theguardian.com/world/2013/jul/30/bradley-manning-trial-verdict-live

http://www.theguardian.com/world/2013/jul/30/bradley-manning-trial-verdict-live

Sunday, July 28, 2013

A little bit on Gold

Some questions... and answers:

- Isn’t gold a hedge against inflation? – No central banks are showing concerns about inflation.

- Shouldn’t gold act as a safe haven – haven’t seen this at all this year. Why? Fed policy, probably, everyone is interested in equities. Investors see more obvious trades alongside $85bn a clip. People like to trade gold as 1) a currency, 2) a commodity. Looks like it’s moving in tandem with silver.

- Shouldn’t gold prop up because of demand from all these emerging economies? Gold demand is mainly from China and India. China isn’t looking to buy as much gold as the economy’s export growth slows.

The fundamentals haven't supported gold for a while but there has been a recent uptrend, with Gold topping 1300. Technicals, such as RSI (60+), along with the wedge suggests that gold may see a retracement. Some analysts are looking at a target sub- 1000 by the end of 2013; others are still looking at levels up to 1500. An interesting video on the subject can be found here:

DailyFx Gold Roundtable July 26th

Some people have a very different view however:

"Shrugging Off the Bears, Schiff Launches New Gold Mutual Fund"

Thursday, July 25, 2013

Friday, July 19, 2013

Detroit Bankruptcy, DJIA all time highs (18th July), there's something wrong here. What lies ahead for the US?

I want to take this opportunity to highlight what is structurally wrong with the US. I hope that this bankruptcy will drive people to more realistic expectations than just inflated bullshit, and that Detroit can prosper through a restructuring of its economy. I do not profess to know much about Detroit, but I can tell you the following points about the US that should hopefully provide some food for thought:

US national debt is 17x larger than it was 30 years ago.

Total amount of debt in the country is 28x larger than 40 years ago.

Measuring GDP per capita - US is 14th in the world, it used to be 1st.

US' GDP accounted for 31.8% of global GDP in 2001, in 2011 it stood at 21.6%.

Since 2000, size of US national debt has grown by $11trn.

2000 - trade deficit with China was $83 billion. Last year - 315bn.

Official unemployment rate has been at 7.5%+ for 54 months in a row - longest stretch in US history.

Homeownership rate is at its lowest level in 18 years.

More than 1 million public school student in the US are homeless. The first time this has ever happened. That number represents a rise of 57% since 06/07.

Now some of these points aren't necessarily due to US weakening, but global growth elsewhere, but just wanted to provide you some statistics which really astounded me.

Wednesday, July 17, 2013

17th July 2013 - So far

European stock markets trading flat this morning

USD trading higher against rivals, in core govt bonds (Bunds and Gilts are also flat)

USD trading higher against rivals, in core govt bonds (Bunds and Gilts are also flat)

16th – some losses for the Dow and S&P, very

strong numbers from Goldman Sachs.

Today and tomorrow – focus on Bernanke’s testimony. Probably signal tapering as early as the start of 2014, and keep interest rates at record lows. All eyes on this!

Unemployment data for the UK came out – ONS released the data just over an hour ago, which shows the biggest fall in 11 years - falls by 57000 to 2.51 million in the 3 months to May. This means that the unemployment rate is at 7.8% (down from 8.0%) However, Scottish unemployment rises by 8,000 increasing for the first time this year (7.5% unemployment – 205,000 out of work! So still in a better position than the rest of the UK)

Tuesday, July 16, 2013

Monday, July 15, 2013

Chinese Data out! Global markets gain.

Last week, Finance Minister Lou Jiwei said last that 6.5% expansion wouldn’t be a “big problem”, presumably to give the markets some expectations and along with that taper volatility. But to set 6.5% in the speech, a figure lower than usual isn't something that China really does. Awkward behaviour, especially as results came out today that China expanded 7.5 percent in the three months to June 30. Perhaps they are trying to artificially drive a rally by pricing in lower expectations with a better than expected results - or to assuage amidst otherwise bog-standard results. I don't think that these latest results will see markets rally, but post some short term gains. This may bode well for the AUSUSD also, something that I will come to later in the week after Bernanke's speech on Wednesday.

More to come on EM gains, European, APAC and US gains.

More to come on EM gains, European, APAC and US gains.

Sunday, July 14, 2013

Friday, July 12, 2013

Recap and forecast for week beginning Monday 15th July

Exciting week!

High level probability of high volatility.

S&P 500 - the outstanding performer of the week. Consistent, consecutive move that put us to a record high! 7 consecutive days! We've only seen three 7 day runs going back 6 years, although we say a remarkable quiet day on the final day of the week. This brings some concern that this isn't a steady and consistent risk positive drive. From a purely fundamental perspective, this advance is probably trouble. Obviously, the driver was the FOMC speech. The potential of expansion for the S&P has to be pretty low in my opinion, and if it rolls over (as we saw around 20/21st June when the taper concept was further put out there by the FED) then there is concern for a big downside move.

Actually if we look below, we see the comparison between the S&P 500 vs the Deutsche Bank Carry Trade Index, correlation is quite remarkable - but look at the gap that we see currently! Cause for concern? Maybe!

High level probability of high volatility.

S&P 500 - the outstanding performer of the week. Consistent, consecutive move that put us to a record high! 7 consecutive days! We've only seen three 7 day runs going back 6 years, although we say a remarkable quiet day on the final day of the week. This brings some concern that this isn't a steady and consistent risk positive drive. From a purely fundamental perspective, this advance is probably trouble. Obviously, the driver was the FOMC speech. The potential of expansion for the S&P has to be pretty low in my opinion, and if it rolls over (as we saw around 20/21st June when the taper concept was further put out there by the FED) then there is concern for a big downside move.

Actually if we look below, we see the comparison between the S&P 500 vs the Deutsche Bank Carry Trade Index, correlation is quite remarkable - but look at the gap that we see currently! Cause for concern? Maybe!

Actually if you look vs FX markets, the dollar lost a lot of ground and then recouped. The dollar index had a massive 2 day decline, and then on Friday ended up!

More to follow!

Wednesday, July 10, 2013

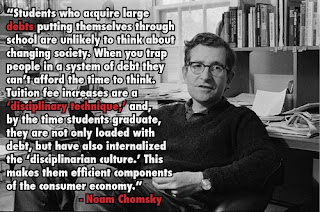

Student fees drive students to sex work; alternatives to a brick and mortar institution.

When studying at LSE, I was lucky enough to be granted a bursary by the university and a full maintenance grant from the SLC, whilst tuition fees did not raise above £3,300 a year (loans available for tuition and living). Now, home students at LSE pay £8,500, (although the grants have gone up by 25% for my level). Students throughout the rest of the UK are forking up to £9,000 a year for tuition at an undergraduate level. And whilst loans are available, the thought alone of being in this kind of debt can be quite worrying. Apparently as much as 6% of students could be involved in sex work (although this based on an incredibly small sample of 200 students).

Then thinking about postgraduate work, where fees can rise up to as much as £30,000 a year, (LSE MSc Economics at £21,000, LSE MSc Finance at over £26,000, Imperial MSc in Risk Management and Financial Engineering at £28,000); although some Master's courses can often cost less than a single year at undergraduate it is clear that higher education is not particularly accessible in the UK at the so-called 'elite' institutions.

Take a look at this regarding students in sex work: http://www.independent.co.uk/student/news/sex-for-tuition-fees-are-universities-just-refusing-to-face-up-to-the-facts-8667648.html

Education increasingly seems to be becoming more of a private investment rather than a public good. Luckily there are alternatives, with IIT-MIT-Harvard's online courses platform Edx https://www.edx.org/; and other open courses available online, although these don't come with the piece of paper/certificate that people value so much nor contact time. There are other courses providing this piece of paper, although not from particularly 'elite' universities, you can undertake the external programme at the University of London, the courses are tailored by various UoL universities such as the London School of Economics, SOAS and Goldsmiths, but again you don't get any contact time. No comment here on the practicality of the education/schooling, or force-fed syllabi.

I'll leave you with this as some food for thought:

The S word: Taking a look at Sexism surrounding Wimbledon.

On Bartoli - Wimbledon Champion

See: http://publicshaming.tumblr.com/post/54864863081/womens-wimbledon-champion-marion-bartoli-deemed

Malevolent, made worse by the fact that the BBC apparently joined in, with John Inverdale commenting that she would "never be a looker". For anyone who still believes that sexism is a thing of the past, try and argue that after reading some of these posts. That being said, Bartoli's response to the matter was very graceful:

On Wade - Written out of the history books

See: http://www.guardian.co.uk/sport/shortcuts/2013/jul/08/virginia-wade-wimbledon-champion-tennis

See: http://www.guardian.co.uk/sport/shortcuts/2013/jul/08/virginia-wade-wimbledon-champion-tennis

Tuesday, July 9, 2013

9th July 2013 - Earning season starts, FOMC speech tomorrow; EURUSD hit, Aid with Greece, Italy downgrade; APAC is up but not away; NYSE Euronext buy LIBOR

United States - Earning season starts, FOMC speech tomorrow

Stocks up on optimistic expectations for earnings season. Investors are becoming more thick skinned, and increasingly comfortable with potential that the FED will slow QE. Expectations are that Q2 results will be soft, and show weak sales, expectations that results will pick up in the rest of the year. DJIA up 0.5%, S&P 0.7%, NDAQ 0.6%. NYSE Euronext will buy the LIBOR!The US dollar was up against the pound, yen, euro and the Swiss franc. It declined against the Canadian and Australian dollars. The Dollar Index was up 0.5%. T-Bill yields flat.

Europe - EURUSD hit, Aid with Greece, Italy downgrade

Stocks mostly higher for the second day after Eurozone finance ministers agreed on an aid disbursement for Greece (although lower than expected -> of course EURUSD took a hit). Doesn't look great for the public - take a look at this public sector worker dismissal policy : http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_09/07/2013_508286

Markets’ gains weakened after the IMF slashed its global growth forecast. FTSE and SMI up 1.0%, DAX 1.1% and CAC 0.5%.EU finance ministers approved payment of €3bn to Greece, in 2 tranches – with strict conditions regarding the restructuring of its economy. €2.5bn to be paid this month, €0.5bn in October. Greece has to satisfy all agreed commitments in July itself. Reforms are mainly surrounding public admin and tax revenue collection.Banking stocks advanced. LVMH up after assenting to buy 80% of Loro Piana (Italian luxury cashmere clothing company) for €2bn. Shell announced a new CE. Mining stocks were up. S&P downgraded Italy's sovereign credit rating to BBB (previously BBB+) (after markets closed) with Outlook: negative.

Stocks up on optimistic expectations for earnings season. Investors are becoming more thick skinned, and increasingly comfortable with potential that the FED will slow QE. Expectations are that Q2 results will be soft, and show weak sales, expectations that results will pick up in the rest of the year. DJIA up 0.5%, S&P 0.7%, NDAQ 0.6%. NYSE Euronext will buy the LIBOR!The US dollar was up against the pound, yen, euro and the Swiss franc. It declined against the Canadian and Australian dollars. The Dollar Index was up 0.5%. T-Bill yields flat.

Europe - EURUSD hit, Aid with Greece, Italy downgrade

Stocks mostly higher for the second day after Eurozone finance ministers agreed on an aid disbursement for Greece (although lower than expected -> of course EURUSD took a hit). Doesn't look great for the public - take a look at this public sector worker dismissal policy : http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_09/07/2013_508286

Markets’ gains weakened after the IMF slashed its global growth forecast. FTSE and SMI up 1.0%, DAX 1.1% and CAC 0.5%.EU finance ministers approved payment of €3bn to Greece, in 2 tranches – with strict conditions regarding the restructuring of its economy. €2.5bn to be paid this month, €0.5bn in October. Greece has to satisfy all agreed commitments in July itself. Reforms are mainly surrounding public admin and tax revenue collection.Banking stocks advanced. LVMH up after assenting to buy 80% of Loro Piana (Italian luxury cashmere clothing company) for €2bn. Shell announced a new CE. Mining stocks were up. S&P downgraded Italy's sovereign credit rating to BBB (previously BBB+) (after markets closed) with Outlook: negative.

Asia Pacific - Up but not away

Markets rallied, although were limited by concern regarding China's slowdown and liquidity problems, as well as general restraint prior FOMC June minutes’ release (due tomorrow; for which USD will probably rise although to a lower extent than most people think - it's already priced in! But I have a suspicion that as unemployment is still above 7% that QE could be delayed in which case we could see USD weaken, expecting EURUSD to reach 1.30 in this case). Encouraging news from Europe (re Greece/Portugal) along a decent start to Q2 earnings season in the US helped the rally to an extent.

Nikkei up 2.6% (http://uk.reuters.com/article/2013/07/09/markets-japan-stocks-idUKL4N0FF2BY20130709) although I believe that it will open lower tomorrow. For now, however, it is at its highest in more than a month (helped along by a weaker yen improving risk appetite)

Shanghai Composite up 0.4% after Monday's -2.4%. Hang Seng 0.5%.

Some interesting charts from Goldman, have a look

Very obscure, read the story here: http://www.zerohedge.com/news/2013-07-09/three-funny-charts

Very cool video: Hans Rosling's 200 Countries, 200 Years, 4 Minutes: The joy of stats

Click here https://www.youtube.com/watch?feature=player_embedded&v=jbkSRLYSoj

To find some of the material used in this video, visit www.gapminder.org

To find some of the material used in this video, visit www.gapminder.org

Recap 8 July 2013 - Europe rebounds, US data is strong, APAC retreats

- US, not bad.

Shares advanced. Strength came as markets viewed Friday's month employment report favourably - this showed stronger than expected job growth un June. Increased optimism of the economic outlook -> increased speculation that Fed will begin scaling back its 85bn a clip stimulus program.

Typical of Mondays in July and August, markets were still pretty thin. Decline in T-bills -> help of a boost in stocks as well (some rotation here).

Dell jumped after ISS - the largest US shareholder advisory firm - recommended that shareholders vote CEO Michael Dell's $24.4bn buyout - http://uk.reuters.com/article/2013/07/08/uk-dell-investors-idUKBRE9670HS20130708

- Europe rebounds; German production down; Agreement between Greece and Troika!

European markets were up, with FTSE 1.2% up, CAC 1.9% up, DAX 2.1%! and SMI 1.0% up.

Agreement reached between Greece and the Troika ahead of Eurozone finance ministers meeting in Vrussels. German industrial production for May declined more than expected, falling 1% MoM (the steepest since 10/2012) Expectations were at a 0.5% fall after a 2% rise in April. German trade surplus declined in May (sharp decline in imports, while imports increased!).

- APAC

Shares advanced. Strength came as markets viewed Friday's month employment report favourably - this showed stronger than expected job growth un June. Increased optimism of the economic outlook -> increased speculation that Fed will begin scaling back its 85bn a clip stimulus program.

Typical of Mondays in July and August, markets were still pretty thin. Decline in T-bills -> help of a boost in stocks as well (some rotation here).

Dell jumped after ISS - the largest US shareholder advisory firm - recommended that shareholders vote CEO Michael Dell's $24.4bn buyout - http://uk.reuters.com/article/2013/07/08/uk-dell-investors-idUKBRE9670HS20130708

- Europe rebounds; German production down; Agreement between Greece and Troika!

European markets were up, with FTSE 1.2% up, CAC 1.9% up, DAX 2.1%! and SMI 1.0% up.

Agreement reached between Greece and the Troika ahead of Eurozone finance ministers meeting in Vrussels. German industrial production for May declined more than expected, falling 1% MoM (the steepest since 10/2012) Expectations were at a 0.5% fall after a 2% rise in April. German trade surplus declined in May (sharp decline in imports, while imports increased!).

- APAC

Thursday, July 4, 2013

Interesting read on the revolution in Egypt

"Of all the ways Morsi could fall this is the best and the worst. The best because it arose out of the huge revolutionary mobilisation of the June 30th demonstrations. The worst because the Egyptian army acted to stop a deepening of that mobilisation which could have threatened not just the Morsi government but the entire power structure of the capitalist class."

See here:

http://www.counterfire.org/index.php/articles/international/16552-the-army-acted-to-limit-the-revolution-not-to-lead-it

See here:

http://www.counterfire.org/index.php/articles/international/16552-the-army-acted-to-limit-the-revolution-not-to-lead-it

Tuesday, July 2, 2013

2nd July 2013 - Portugal, Greece sends Euro down; Egypt tensions continue; Fed approves Basel rules

- Portugal, Greece sends Euro 0.6% down

Today one of my work colleagues put on a trade at 5:something am, EURUSD was at 1.3057, he put a 20bps stop limit (1.3077), it hit 1.3078 (unlucky!), and then it went down past his target price of 1.3000 then slightly up, and then hit 1.2981 (time of writing) (source: Yahoo Finance!)

- Fed approves Basel rules!

Read: http://www.washingtonpost.com/business/economy/the-fed-approves-final-basel-rules/2013/07/02/6c9d6ea2-e313-11e2-80eb-3145e2994a55_story.html

Read: http://www.washingtonpost.com/business/economy/the-fed-approves-final-basel-rules/2013/07/02/6c9d6ea2-e313-11e2-80eb-3145e2994a55_story.html

- US DJIA slightly lower, S&P essentially flat

The S&P 500 fell < 1pt; DJIA down 0.29%. Market sold off slightly in the final few hours over tensions in Egypt and concerns over Fed’s Basel decision release.

The S&P 500 fell < 1pt; DJIA down 0.29%. Market sold off slightly in the final few hours over tensions in Egypt and concerns over Fed’s Basel decision release.

The NSA and Algorithms

To quote a friend - Akash Shaikh, 'The laws in the US and UK say that much of this [the NSA revelations] is allowed, it's just that most people don't realise yet. But there is a big question about oversight. We now spend so much of our time online that we are creating huge data-mining opportunities.'

Read this, very interesting: http://www.guardian.co.uk/science/2013/jul/01/how-algorithms-rule-world-nsa

Read this, very interesting: http://www.guardian.co.uk/science/2013/jul/01/how-algorithms-rule-world-nsa

Photos from Tahrir Square and other articles on Egypt

Have a look:

http://www.zerohedge.com/news/2013-07-02/guest-post-egyptians-love-us-our-freedomAnd then, have a think.

BBC's 90 second recap on Mubarak to Mursi: http://www.bbc.co.uk/news/world-middle-east-23155829

Mubarak says Mursi should step down (You can't make this stuff up!) - http://english.alarabiya.net/en/News/middle-east/2013/07/02/Mursi-must-step-down-Egypt-s-ousted-president-says.html

The finance side: Egypt CDS have widened by 50% in the last month.

Subscribe to:

Comments (Atom)

.bmp)