http://rt.com/business/us-adds-gdp-history-changed-740/

Tuesday, July 30, 2013

Bradley Manning. Salute.

Bradley Manning verdict: guilty of most charges but not 'aiding enemy' – live

http://www.theguardian.com/world/2013/jul/30/bradley-manning-trial-verdict-live

http://www.theguardian.com/world/2013/jul/30/bradley-manning-trial-verdict-live

Sunday, July 28, 2013

A little bit on Gold

Some questions... and answers:

- Isn’t gold a hedge against inflation? – No central banks are showing concerns about inflation.

- Shouldn’t gold act as a safe haven – haven’t seen this at all this year. Why? Fed policy, probably, everyone is interested in equities. Investors see more obvious trades alongside $85bn a clip. People like to trade gold as 1) a currency, 2) a commodity. Looks like it’s moving in tandem with silver.

- Shouldn’t gold prop up because of demand from all these emerging economies? Gold demand is mainly from China and India. China isn’t looking to buy as much gold as the economy’s export growth slows.

The fundamentals haven't supported gold for a while but there has been a recent uptrend, with Gold topping 1300. Technicals, such as RSI (60+), along with the wedge suggests that gold may see a retracement. Some analysts are looking at a target sub- 1000 by the end of 2013; others are still looking at levels up to 1500. An interesting video on the subject can be found here:

DailyFx Gold Roundtable July 26th

Some people have a very different view however:

"Shrugging Off the Bears, Schiff Launches New Gold Mutual Fund"

Thursday, July 25, 2013

Friday, July 19, 2013

Detroit Bankruptcy, DJIA all time highs (18th July), there's something wrong here. What lies ahead for the US?

I want to take this opportunity to highlight what is structurally wrong with the US. I hope that this bankruptcy will drive people to more realistic expectations than just inflated bullshit, and that Detroit can prosper through a restructuring of its economy. I do not profess to know much about Detroit, but I can tell you the following points about the US that should hopefully provide some food for thought:

US national debt is 17x larger than it was 30 years ago.

Total amount of debt in the country is 28x larger than 40 years ago.

Measuring GDP per capita - US is 14th in the world, it used to be 1st.

US' GDP accounted for 31.8% of global GDP in 2001, in 2011 it stood at 21.6%.

Since 2000, size of US national debt has grown by $11trn.

2000 - trade deficit with China was $83 billion. Last year - 315bn.

Official unemployment rate has been at 7.5%+ for 54 months in a row - longest stretch in US history.

Homeownership rate is at its lowest level in 18 years.

More than 1 million public school student in the US are homeless. The first time this has ever happened. That number represents a rise of 57% since 06/07.

Now some of these points aren't necessarily due to US weakening, but global growth elsewhere, but just wanted to provide you some statistics which really astounded me.

Wednesday, July 17, 2013

17th July 2013 - So far

European stock markets trading flat this morning

USD trading higher against rivals, in core govt bonds (Bunds and Gilts are also flat)

USD trading higher against rivals, in core govt bonds (Bunds and Gilts are also flat)

16th – some losses for the Dow and S&P, very

strong numbers from Goldman Sachs.

Today and tomorrow – focus on Bernanke’s testimony. Probably signal tapering as early as the start of 2014, and keep interest rates at record lows. All eyes on this!

Unemployment data for the UK came out – ONS released the data just over an hour ago, which shows the biggest fall in 11 years - falls by 57000 to 2.51 million in the 3 months to May. This means that the unemployment rate is at 7.8% (down from 8.0%) However, Scottish unemployment rises by 8,000 increasing for the first time this year (7.5% unemployment – 205,000 out of work! So still in a better position than the rest of the UK)

Tuesday, July 16, 2013

Monday, July 15, 2013

Chinese Data out! Global markets gain.

Last week, Finance Minister Lou Jiwei said last that 6.5% expansion wouldn’t be a “big problem”, presumably to give the markets some expectations and along with that taper volatility. But to set 6.5% in the speech, a figure lower than usual isn't something that China really does. Awkward behaviour, especially as results came out today that China expanded 7.5 percent in the three months to June 30. Perhaps they are trying to artificially drive a rally by pricing in lower expectations with a better than expected results - or to assuage amidst otherwise bog-standard results. I don't think that these latest results will see markets rally, but post some short term gains. This may bode well for the AUSUSD also, something that I will come to later in the week after Bernanke's speech on Wednesday.

More to come on EM gains, European, APAC and US gains.

More to come on EM gains, European, APAC and US gains.

Sunday, July 14, 2013

Friday, July 12, 2013

Recap and forecast for week beginning Monday 15th July

Exciting week!

High level probability of high volatility.

S&P 500 - the outstanding performer of the week. Consistent, consecutive move that put us to a record high! 7 consecutive days! We've only seen three 7 day runs going back 6 years, although we say a remarkable quiet day on the final day of the week. This brings some concern that this isn't a steady and consistent risk positive drive. From a purely fundamental perspective, this advance is probably trouble. Obviously, the driver was the FOMC speech. The potential of expansion for the S&P has to be pretty low in my opinion, and if it rolls over (as we saw around 20/21st June when the taper concept was further put out there by the FED) then there is concern for a big downside move.

Actually if we look below, we see the comparison between the S&P 500 vs the Deutsche Bank Carry Trade Index, correlation is quite remarkable - but look at the gap that we see currently! Cause for concern? Maybe!

High level probability of high volatility.

S&P 500 - the outstanding performer of the week. Consistent, consecutive move that put us to a record high! 7 consecutive days! We've only seen three 7 day runs going back 6 years, although we say a remarkable quiet day on the final day of the week. This brings some concern that this isn't a steady and consistent risk positive drive. From a purely fundamental perspective, this advance is probably trouble. Obviously, the driver was the FOMC speech. The potential of expansion for the S&P has to be pretty low in my opinion, and if it rolls over (as we saw around 20/21st June when the taper concept was further put out there by the FED) then there is concern for a big downside move.

Actually if we look below, we see the comparison between the S&P 500 vs the Deutsche Bank Carry Trade Index, correlation is quite remarkable - but look at the gap that we see currently! Cause for concern? Maybe!

Actually if you look vs FX markets, the dollar lost a lot of ground and then recouped. The dollar index had a massive 2 day decline, and then on Friday ended up!

More to follow!

Wednesday, July 10, 2013

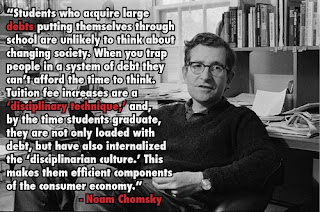

Student fees drive students to sex work; alternatives to a brick and mortar institution.

When studying at LSE, I was lucky enough to be granted a bursary by the university and a full maintenance grant from the SLC, whilst tuition fees did not raise above £3,300 a year (loans available for tuition and living). Now, home students at LSE pay £8,500, (although the grants have gone up by 25% for my level). Students throughout the rest of the UK are forking up to £9,000 a year for tuition at an undergraduate level. And whilst loans are available, the thought alone of being in this kind of debt can be quite worrying. Apparently as much as 6% of students could be involved in sex work (although this based on an incredibly small sample of 200 students).

Then thinking about postgraduate work, where fees can rise up to as much as £30,000 a year, (LSE MSc Economics at £21,000, LSE MSc Finance at over £26,000, Imperial MSc in Risk Management and Financial Engineering at £28,000); although some Master's courses can often cost less than a single year at undergraduate it is clear that higher education is not particularly accessible in the UK at the so-called 'elite' institutions.

Take a look at this regarding students in sex work: http://www.independent.co.uk/student/news/sex-for-tuition-fees-are-universities-just-refusing-to-face-up-to-the-facts-8667648.html

Education increasingly seems to be becoming more of a private investment rather than a public good. Luckily there are alternatives, with IIT-MIT-Harvard's online courses platform Edx https://www.edx.org/; and other open courses available online, although these don't come with the piece of paper/certificate that people value so much nor contact time. There are other courses providing this piece of paper, although not from particularly 'elite' universities, you can undertake the external programme at the University of London, the courses are tailored by various UoL universities such as the London School of Economics, SOAS and Goldsmiths, but again you don't get any contact time. No comment here on the practicality of the education/schooling, or force-fed syllabi.

I'll leave you with this as some food for thought:

The S word: Taking a look at Sexism surrounding Wimbledon.

On Bartoli - Wimbledon Champion

See: http://publicshaming.tumblr.com/post/54864863081/womens-wimbledon-champion-marion-bartoli-deemed

Malevolent, made worse by the fact that the BBC apparently joined in, with John Inverdale commenting that she would "never be a looker". For anyone who still believes that sexism is a thing of the past, try and argue that after reading some of these posts. That being said, Bartoli's response to the matter was very graceful:

On Wade - Written out of the history books

See: http://www.guardian.co.uk/sport/shortcuts/2013/jul/08/virginia-wade-wimbledon-champion-tennis

See: http://www.guardian.co.uk/sport/shortcuts/2013/jul/08/virginia-wade-wimbledon-champion-tennis

Tuesday, July 9, 2013

9th July 2013 - Earning season starts, FOMC speech tomorrow; EURUSD hit, Aid with Greece, Italy downgrade; APAC is up but not away; NYSE Euronext buy LIBOR

United States - Earning season starts, FOMC speech tomorrow

Stocks up on optimistic expectations for earnings season. Investors are becoming more thick skinned, and increasingly comfortable with potential that the FED will slow QE. Expectations are that Q2 results will be soft, and show weak sales, expectations that results will pick up in the rest of the year. DJIA up 0.5%, S&P 0.7%, NDAQ 0.6%. NYSE Euronext will buy the LIBOR!The US dollar was up against the pound, yen, euro and the Swiss franc. It declined against the Canadian and Australian dollars. The Dollar Index was up 0.5%. T-Bill yields flat.

Europe - EURUSD hit, Aid with Greece, Italy downgrade

Stocks mostly higher for the second day after Eurozone finance ministers agreed on an aid disbursement for Greece (although lower than expected -> of course EURUSD took a hit). Doesn't look great for the public - take a look at this public sector worker dismissal policy : http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_09/07/2013_508286

Markets’ gains weakened after the IMF slashed its global growth forecast. FTSE and SMI up 1.0%, DAX 1.1% and CAC 0.5%.EU finance ministers approved payment of €3bn to Greece, in 2 tranches – with strict conditions regarding the restructuring of its economy. €2.5bn to be paid this month, €0.5bn in October. Greece has to satisfy all agreed commitments in July itself. Reforms are mainly surrounding public admin and tax revenue collection.Banking stocks advanced. LVMH up after assenting to buy 80% of Loro Piana (Italian luxury cashmere clothing company) for €2bn. Shell announced a new CE. Mining stocks were up. S&P downgraded Italy's sovereign credit rating to BBB (previously BBB+) (after markets closed) with Outlook: negative.

Stocks up on optimistic expectations for earnings season. Investors are becoming more thick skinned, and increasingly comfortable with potential that the FED will slow QE. Expectations are that Q2 results will be soft, and show weak sales, expectations that results will pick up in the rest of the year. DJIA up 0.5%, S&P 0.7%, NDAQ 0.6%. NYSE Euronext will buy the LIBOR!The US dollar was up against the pound, yen, euro and the Swiss franc. It declined against the Canadian and Australian dollars. The Dollar Index was up 0.5%. T-Bill yields flat.

Europe - EURUSD hit, Aid with Greece, Italy downgrade

Stocks mostly higher for the second day after Eurozone finance ministers agreed on an aid disbursement for Greece (although lower than expected -> of course EURUSD took a hit). Doesn't look great for the public - take a look at this public sector worker dismissal policy : http://www.ekathimerini.com/4dcgi/_w_articles_wsite1_1_09/07/2013_508286

Markets’ gains weakened after the IMF slashed its global growth forecast. FTSE and SMI up 1.0%, DAX 1.1% and CAC 0.5%.EU finance ministers approved payment of €3bn to Greece, in 2 tranches – with strict conditions regarding the restructuring of its economy. €2.5bn to be paid this month, €0.5bn in October. Greece has to satisfy all agreed commitments in July itself. Reforms are mainly surrounding public admin and tax revenue collection.Banking stocks advanced. LVMH up after assenting to buy 80% of Loro Piana (Italian luxury cashmere clothing company) for €2bn. Shell announced a new CE. Mining stocks were up. S&P downgraded Italy's sovereign credit rating to BBB (previously BBB+) (after markets closed) with Outlook: negative.

Asia Pacific - Up but not away

Markets rallied, although were limited by concern regarding China's slowdown and liquidity problems, as well as general restraint prior FOMC June minutes’ release (due tomorrow; for which USD will probably rise although to a lower extent than most people think - it's already priced in! But I have a suspicion that as unemployment is still above 7% that QE could be delayed in which case we could see USD weaken, expecting EURUSD to reach 1.30 in this case). Encouraging news from Europe (re Greece/Portugal) along a decent start to Q2 earnings season in the US helped the rally to an extent.

Nikkei up 2.6% (http://uk.reuters.com/article/2013/07/09/markets-japan-stocks-idUKL4N0FF2BY20130709) although I believe that it will open lower tomorrow. For now, however, it is at its highest in more than a month (helped along by a weaker yen improving risk appetite)

Shanghai Composite up 0.4% after Monday's -2.4%. Hang Seng 0.5%.

Some interesting charts from Goldman, have a look

Very obscure, read the story here: http://www.zerohedge.com/news/2013-07-09/three-funny-charts

Very cool video: Hans Rosling's 200 Countries, 200 Years, 4 Minutes: The joy of stats

Click here https://www.youtube.com/watch?feature=player_embedded&v=jbkSRLYSoj

To find some of the material used in this video, visit www.gapminder.org

To find some of the material used in this video, visit www.gapminder.org

Recap 8 July 2013 - Europe rebounds, US data is strong, APAC retreats

- US, not bad.

Shares advanced. Strength came as markets viewed Friday's month employment report favourably - this showed stronger than expected job growth un June. Increased optimism of the economic outlook -> increased speculation that Fed will begin scaling back its 85bn a clip stimulus program.

Typical of Mondays in July and August, markets were still pretty thin. Decline in T-bills -> help of a boost in stocks as well (some rotation here).

Dell jumped after ISS - the largest US shareholder advisory firm - recommended that shareholders vote CEO Michael Dell's $24.4bn buyout - http://uk.reuters.com/article/2013/07/08/uk-dell-investors-idUKBRE9670HS20130708

- Europe rebounds; German production down; Agreement between Greece and Troika!

European markets were up, with FTSE 1.2% up, CAC 1.9% up, DAX 2.1%! and SMI 1.0% up.

Agreement reached between Greece and the Troika ahead of Eurozone finance ministers meeting in Vrussels. German industrial production for May declined more than expected, falling 1% MoM (the steepest since 10/2012) Expectations were at a 0.5% fall after a 2% rise in April. German trade surplus declined in May (sharp decline in imports, while imports increased!).

- APAC

Shares advanced. Strength came as markets viewed Friday's month employment report favourably - this showed stronger than expected job growth un June. Increased optimism of the economic outlook -> increased speculation that Fed will begin scaling back its 85bn a clip stimulus program.

Typical of Mondays in July and August, markets were still pretty thin. Decline in T-bills -> help of a boost in stocks as well (some rotation here).

Dell jumped after ISS - the largest US shareholder advisory firm - recommended that shareholders vote CEO Michael Dell's $24.4bn buyout - http://uk.reuters.com/article/2013/07/08/uk-dell-investors-idUKBRE9670HS20130708

- Europe rebounds; German production down; Agreement between Greece and Troika!

European markets were up, with FTSE 1.2% up, CAC 1.9% up, DAX 2.1%! and SMI 1.0% up.

Agreement reached between Greece and the Troika ahead of Eurozone finance ministers meeting in Vrussels. German industrial production for May declined more than expected, falling 1% MoM (the steepest since 10/2012) Expectations were at a 0.5% fall after a 2% rise in April. German trade surplus declined in May (sharp decline in imports, while imports increased!).

- APAC

Thursday, July 4, 2013

Interesting read on the revolution in Egypt

"Of all the ways Morsi could fall this is the best and the worst. The best because it arose out of the huge revolutionary mobilisation of the June 30th demonstrations. The worst because the Egyptian army acted to stop a deepening of that mobilisation which could have threatened not just the Morsi government but the entire power structure of the capitalist class."

See here:

http://www.counterfire.org/index.php/articles/international/16552-the-army-acted-to-limit-the-revolution-not-to-lead-it

See here:

http://www.counterfire.org/index.php/articles/international/16552-the-army-acted-to-limit-the-revolution-not-to-lead-it

Tuesday, July 2, 2013

2nd July 2013 - Portugal, Greece sends Euro down; Egypt tensions continue; Fed approves Basel rules

- Portugal, Greece sends Euro 0.6% down

Today one of my work colleagues put on a trade at 5:something am, EURUSD was at 1.3057, he put a 20bps stop limit (1.3077), it hit 1.3078 (unlucky!), and then it went down past his target price of 1.3000 then slightly up, and then hit 1.2981 (time of writing) (source: Yahoo Finance!)

- Fed approves Basel rules!

Read: http://www.washingtonpost.com/business/economy/the-fed-approves-final-basel-rules/2013/07/02/6c9d6ea2-e313-11e2-80eb-3145e2994a55_story.html

Read: http://www.washingtonpost.com/business/economy/the-fed-approves-final-basel-rules/2013/07/02/6c9d6ea2-e313-11e2-80eb-3145e2994a55_story.html

- US DJIA slightly lower, S&P essentially flat

The S&P 500 fell < 1pt; DJIA down 0.29%. Market sold off slightly in the final few hours over tensions in Egypt and concerns over Fed’s Basel decision release.

The S&P 500 fell < 1pt; DJIA down 0.29%. Market sold off slightly in the final few hours over tensions in Egypt and concerns over Fed’s Basel decision release.

The NSA and Algorithms

To quote a friend - Akash Shaikh, 'The laws in the US and UK say that much of this [the NSA revelations] is allowed, it's just that most people don't realise yet. But there is a big question about oversight. We now spend so much of our time online that we are creating huge data-mining opportunities.'

Read this, very interesting: http://www.guardian.co.uk/science/2013/jul/01/how-algorithms-rule-world-nsa

Read this, very interesting: http://www.guardian.co.uk/science/2013/jul/01/how-algorithms-rule-world-nsa

Photos from Tahrir Square and other articles on Egypt

Have a look:

http://www.zerohedge.com/news/2013-07-02/guest-post-egyptians-love-us-our-freedomAnd then, have a think.

BBC's 90 second recap on Mubarak to Mursi: http://www.bbc.co.uk/news/world-middle-east-23155829

Mubarak says Mursi should step down (You can't make this stuff up!) - http://english.alarabiya.net/en/News/middle-east/2013/07/02/Mursi-must-step-down-Egypt-s-ousted-president-says.html

The finance side: Egypt CDS have widened by 50% in the last month.

Proof that a Harvard and Oxford Education can mean absolutely nothing: the BitCoin ETF

The Winklevoss twins are planning on launching a BitCoin ETF. Wow (not the good kind of wow).

http://finance.yahoo.com/blogs/breakout/winklevosses-trying-bring-bitcoin-mainstream-investors-171834667.html

Bar scene from Good Will Hunting: http://www.youtube.com/watch?v=QnZ0Y4rvz6E

http://finance.yahoo.com/blogs/breakout/winklevosses-trying-bring-bitcoin-mainstream-investors-171834667.html

Bar scene from Good Will Hunting: http://www.youtube.com/watch?v=QnZ0Y4rvz6E

1st July 2013 Recap - European markets rally; US stocks advance; APAC mixed (kind of); Gold gains; Croatia added to the EU

- United States sees relevant gains in equities amidst a slightly weakening dollar.

DJIA up 0.4%, S&P up 0.5%, Nasdaq up 0.9%. ISM rebounded to 50.9 after May's reading of 49.0, although Markit Manufacturing PMI slips from 52.3 to 51.9. That said, construction spending was up 0.5% and nearing a 4 year high.

Dollar index down 0.2% - up against the yen and Swiss france, but down against the euro, pound, CAD and AUD.

- Europe sees slight rally

Pushing aside weak Chinese Manufacturing data, and seeing a better than expected ISM data in the US, the FTSE saw gains of 1.5%, DAX 0.2%, CAC and SMI up 0.8%.

European manufacturing PMI up to 48.8 (up from 48.3 in May). Germany, Italy and France still contractionary however UK manufacturing saw growth, PMI at a 25 month high of 52.5.

- Croatia added to the EU

First state added since 2007, now the 28th member of the EU.

- Gold jumps 4%

Up $50.75 to $1242.75.

DJIA up 0.4%, S&P up 0.5%, Nasdaq up 0.9%. ISM rebounded to 50.9 after May's reading of 49.0, although Markit Manufacturing PMI slips from 52.3 to 51.9. That said, construction spending was up 0.5% and nearing a 4 year high.

Dollar index down 0.2% - up against the yen and Swiss france, but down against the euro, pound, CAD and AUD.

- Europe sees slight rally

Pushing aside weak Chinese Manufacturing data, and seeing a better than expected ISM data in the US, the FTSE saw gains of 1.5%, DAX 0.2%, CAC and SMI up 0.8%.

European manufacturing PMI up to 48.8 (up from 48.3 in May). Germany, Italy and France still contractionary however UK manufacturing saw growth, PMI at a 25 month high of 52.5.

- Croatia added to the EU

First state added since 2007, now the 28th member of the EU.

- Gold jumps 4%

Up $50.75 to $1242.75.

Monday, July 1, 2013

Non Markets: Interesting read on Racism, even if you don't agree.

Lauryn Hill on racism and the concept of reverse racism.

http://mslaurynhill.tumblr.com/post/53975118543/mlh-on-racism

http://mslaurynhill.tumblr.com/post/53975118543/mlh-on-racism

Weekly Recap - Week ending 28th June 2013: Not bad, not great

- The real Real skinny

The real skinny: http://www.zerohedge.com/news/2013-07-01/biggest-problem-currently

- Better Market results than expected (for now...)

- Frontrunning: Fed tapering?

QE infinity (and beyond...) dead?

Why impose QE? To better labour markets; to better downside risks; better housing market. What do we have today? Marginally better labour market, better housing market (for now); smaller fiscal cliff; consumers still consuming. Now that the purpose has been served, it may be time to really speculate that the Fed will taper QE, in fact the Fed's tapering of QE could be construed as a success, as a demonstration that things have improved. Forecast tapering for the end of the year (mainly because I can edit this blog post if I'm wrong).

The real skinny: http://www.zerohedge.com/news/2013-07-01/biggest-problem-currently

- Better Market results than expected (for now...)

- Europe: Confidence slightly up. Although all equity indices down for June, with only CAC and Dax up in the 2nd quarter (0.2% and 2.1% respectively).

- US: Robust new home/pending home sales; higher personal incomes and spending. Case-Shiller home prices increased at a record pace. (see: http://www.calculatedriskblog.com/2013/06/case-shiller-comp-20-house-prices.html) - although: June Chicago PMI slumped to 51.6 (from May's 58.7) However, the final consumer sentiment index from the University of Michigan was upwardly revised to 84.1 from the preliminary reading of 82.7.

- China: Industrial profits up. But continuing worry about growth. Shanghai Composite up 1.5% (property developers lead the way).

- Japan: Better industrial production, construction orders and retail sales. Stocks were up for the week (although down for June), Nikkei advanced during the quarter). Nikkei jumped 3.5% - highest level since 31st May (weaker yen http://uk.finance.yahoo.com/echarts?s=USDJPY%3DX#symbol=;range=1y;compare=;indicator=volume;charttype=area;crosshair=on;ohlcvalues=0;logscale=off;source=undefined;, and tapering concerns slightly put to the side).

- India: Sensex advanced in Q2.

- Frontrunning: Fed tapering?

QE infinity (and beyond...) dead?

Why impose QE? To better labour markets; to better downside risks; better housing market. What do we have today? Marginally better labour market, better housing market (for now); smaller fiscal cliff; consumers still consuming. Now that the purpose has been served, it may be time to really speculate that the Fed will taper QE, in fact the Fed's tapering of QE could be construed as a success, as a demonstration that things have improved. Forecast tapering for the end of the year (mainly because I can edit this blog post if I'm wrong).

Subscribe to:

Comments (Atom)

.bmp)